Last tax year, Renfrew property owners were assessed a 10% tax increase to compensate for the additional burden the completion of the Ma-Te-Way complex represented when the dust finally settled on that project. That 10% increase yielded somewhere in the area of $1 million dollars, and it was proposed at the time that the full additional amount raised be applied to the Ma-Te-Way debenture for the entire thirty-year term of that instrument.

It seems like a clean solution. Sure, nobody’s going to host a block party and applaud a 10% additional hit on their property tax bill, but you grit your teeth and carry on, taking some small measure of comfort knowing that the increase will be perpetually applied to the debenture debt load and interest. But it still chafes to know that you’re paying this levy increase so that the books can look a lot better for property owners thirty years downstream from now. But you do it because you’re an awesome citizen prepared to do your bit for the common good.

Good for you, and thank you.

Have you ever heard of construction loans? They’re exactly as the name implies, loans handed out for construction. They also come with a loan principal and interest rate, like all loans do. And Renfrew has a bunch of them, and the bunch of them generate interest charges somewhere in the area of $775,000/year.

Can you see where this is going yet?

That approximately $1 million that was raised from the additional 10% jump in taxes? Guess where it actually goes? That’s right, it goes to absorbing that construction loan interest, swallowing up the additional tax you paid, leaving around a quarter-million to apply towards Ma-Te-Way debenture payments. Better than nothing, I suppose, but certainly not the full 10% you paid additionally. In percentage terms, your tax increase over the previous year was 10%. Of that, 7.5% went to interest payments on construction loans. The remaining 2.5% went to the Ma-Te-Way debenture.

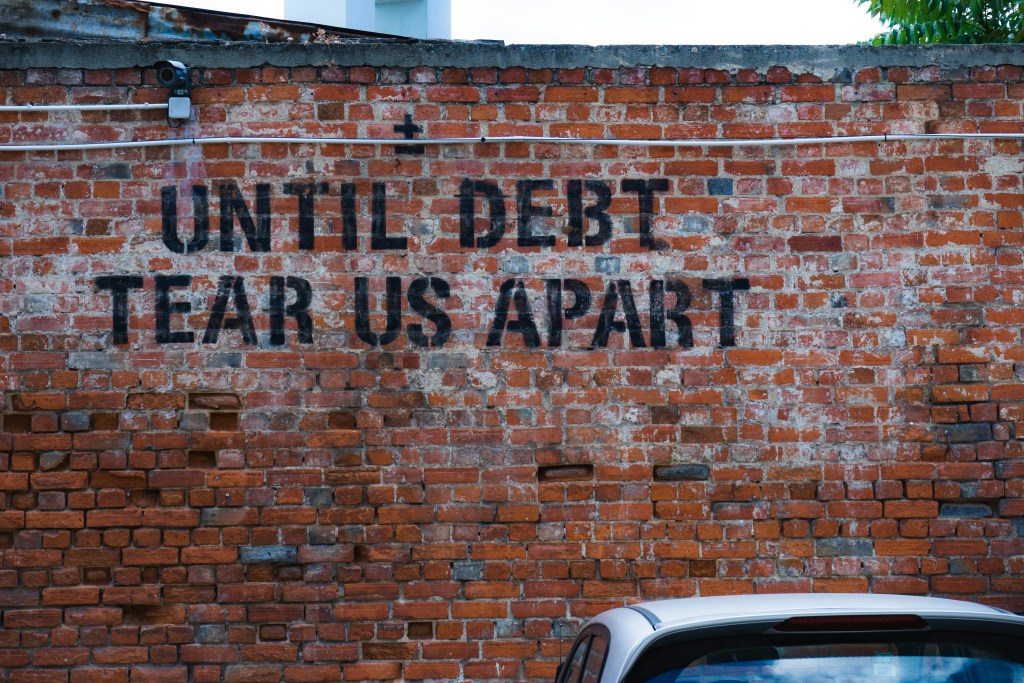

How did this happen, you might ask? It happened because that 10% towards Ma-Te-Way debenture thing was a proposal from a draft document, not an iron-clad strategy. So that’s why that money was able to be diverted to the construction loans. In the grand scheme pf things, I suppose it really doesn’t matter all that much. Debt is debt, and Renfrew has a bunch of it, and it all has to be paid, and you’re the property owner/taxpayer that’s responsible for any of it, and all of it. So I guess it really doesn’t matter if you pay Peter or pay Paul if you owe money to both.

As Renfrew is a member of Renfrew County, its residents are subject to a County levy, or tax, of 5%. Keep that in mind as I attempt to break this down.

In 2024, you received a tax increase of 10% over what you paid previously. That tax increase went towards financing construction loans ($775,000) and the Ma-Te-Way debenture ($225,000). The County levy of 5% is already built into your tax bill, and so that doesn’t represent part of the tax increase because it already existed.

The 2025 budget looks set to add an additional amount of tax onto your bill, somewhere in the area of 13%. That’s 13% on top of the 10% hike last year.

So if you’re doing the math like I am, it looks like Renfrew ratepayers will be paying 23% more money in taxes than they did two years ago.

There’s not enough sugar in the world that can be thrown on news like that to make it come across as any sweeter.

Tax rates are applied against the value of your home or property, so it’s different money for different people, but regardless of what you paid in 2023, you’re looking at paying some 23% more in 2025. So it’s something measured in the hundreds of dollars, no matter where you live in town. And if you’re someone who leveraged too close to the mark when you bought your house, this could be an absolute deal-breaker for you when you see your mortgage payments (property-interest-taxes) rise to the point where they may well become untenable.

Mayor Tom Sidney was worried that all the percentages being tossed around in the Council discussion may be misinterpreted by what he referred to as “keyboard warriors,” ostensibly people who like to take faulty information and run with it. He needn’t fear from this warrior, because this one was present at the time, and has watched the video segment dealing with the town’s debt capacity three times. I think I’m kinda clear on how the percentages work, although those other warriors out there are on their own to do as they will.

There are two types of faulty information. The first kind is when someone takes information and intentionally misrepresents it to serve an agenda of some sort. This is the disingenuous type of person who does this, perhaps even a liar. The second results from faulty presentation of information that comes across as a whack-a-mole session at the Renfrew Fair, with numbers and percentages here, there, and everywhere. This second type of faulty information is difficult for the audience to understand, because there are a lot of balls in the air at the same time, and we’re not all accountants, so they may get it wrong, and with nobody stepping up to make things better understood, it can cause problems for the gavel warriors.

If you’re the one swinging the gavel, the information that comes out of you or your staff is your responsibility, not ours.

If I’ve presented any of the “facts” in this story incorrectly, I ask that someone responsible make an effort to correct me so that I may get it right. My only agenda is an informational one, and so getting things right is definitely part of that.

I, too, do not want anyone laying their heads down on their pillows and contemplating a 23% rise in their taxes for this year alone, or even 28% if you erroneously factor in the County levy of 5%. That would be wrong and irresponsible.

I just want them to drift off knowing that it’s a tax hike in the area of 13% coming this year. And that it’s on top of the 10% last year.

That’s headache enough I’d imagine.