Of all of the nations on this Earth, which one has the greatest level of national debt? If you answered the United States of America, then you’re absolutely right. It appears the world’s richest nation is also the one carrying the biggest debt load. If you think that statement to be one that self-cancels, or doesn’t make any sense, then you haven’t considered why the “Land of the Free” is also the nation with the most citizens behind bars, another little oxymoron that competes with many others. How about the nation with the greatest medical expertise in the world having over 40% of its population without health insurance?

You get the point. The U.S. is a nation of many dichotomies. And debt is one of them.

It’s been okay, though, for all these years, in that the Americans, by virtue of their huge economy, have always shown themselves to be reliable re-payers of debt. And that’s why U.S Treasury Bonds represent an attractive investment, especially for other nations.

Treasury Bonds are financial instruments whereby the U.S. issues what are essentially promissory notes in an effort to obtain the operating cash needed to fund American programs, that is programs that survive Elon’s chainsaw. That means that Treasury Bonds are a debt instrument, where the U.S. is the borrower and the nation holding the bonds is the lender, or banker if you will.

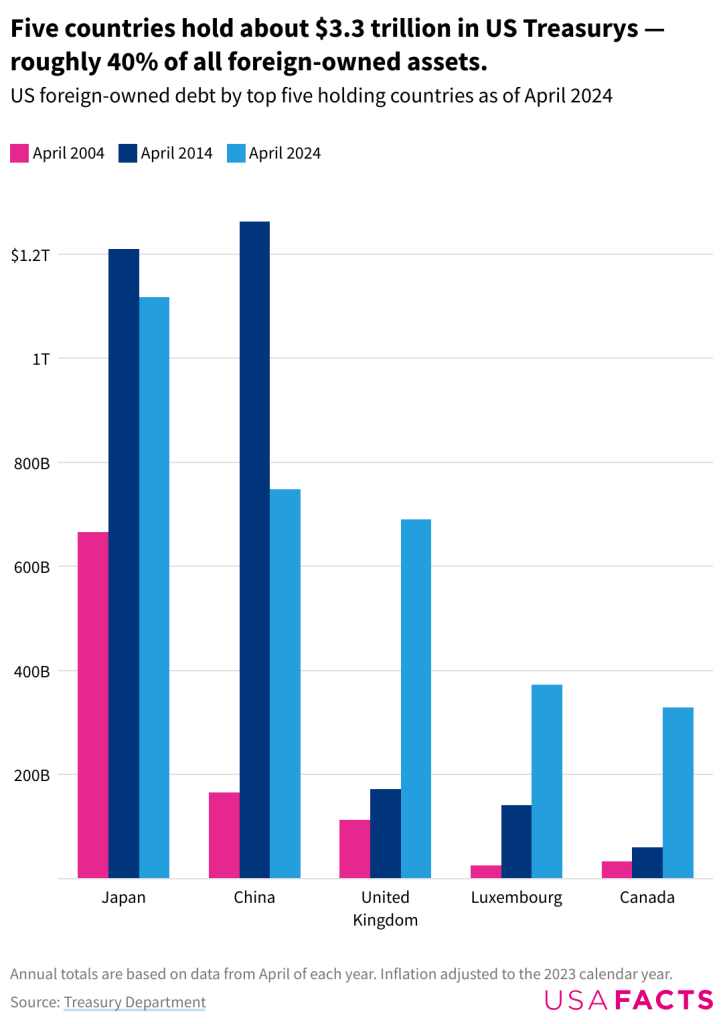

Five nations alone hold over $3.3 trillion of American debt by way of Treasury Bonds, and Canada is one of them, being the holder of some $328 billion. But this is the fifth largest portfolio, because the Japanese own over $1 trillion worth of the things all by themselves, followed by China ($759 billion), the United Kingdom ($723 billion) and Luxembourg ($374 billion).

That’s a lot of potential leverage for a nation on the wrong side of provocative American tariffs and threatening political rhetoric, a situation I believe applies to all five of those countries.

My question is, does the American public know how precarious their economic situation is?

Because if there’s such a thing as short and curlies, that’s what the U.S. is down to when it comes to economic stability. And it can’t possibly help that their president, the one they elected, is actively working against the best interests of his own country, to the benefit of his country’s enemies, namely and mainly Russia, but you can throw China in there too, despite the fact that he’s levied tariffs on them as well.

It seems to me that if confidence in the United States continues to decline across the board, that some of this confidence crisis might likely spread into the debt and debt-holding sphere, with countries perhaps looking at the U.S. debt they hold and calculating that it might be a good time to divest in America, as in get-the-hell-out while you can.

And sell off their U.S. Treasury Bonds.

The average American is already hurting from Trump-inspired policies, especially tariffs and DOGE. The rich folks are all okay, and the billionaires more so than the rest, but for the average Joe, life is getting more challenging. Losing your job, your social security, and if you’re a veteran, your benefits. Those kind of things make life tough. And all of it is self-inflicted.

But if a number of countries really pissed off with being pushed around and insulted decided to off-load their U.S. debt? That’s a recipe for a catastrophic jump in interest rates and a negative effect on the stock market, creating an environment of perilous financial instability. Making it decidedly tougher on Poor Joe, and Jane too.

Some $328 billion of that debt is held by Canada, a nation on the front lines of American economic and political imperialism. Canada is in the process right now of moving away from American things, like fighter jets and Heinz ketchup, so if we really wanted to get ugly, we could sell off our U.S Treasury Bonds. To be truly effective and impactful, that’s something we might want to do in concert with the other Big Five, since selling off those investments only to have some sleaze-ball carpet-bagging country buy all those T-Bills up at reduced prices would be tough to take.

But 3.3 trillion worth being dumped? That would be crippling and would necessitate drastic change in the U.S. to be able to fund the things they want to fund, like tax cuts for billionaires and Elon Musk’s plan to go to Mars and have everyone else pay for it.

That’s how billionaires got to be billionaires in the first place. They used other peoples’ money, never their own.

And I’m all for sending Elon to Mars, but would prefer it to be on a one-way rickshaw. I haven’t worked out the science of it yet, but I feel I’m on the cusp of a good idea. But in a pinch, I’d have no problem jamming a rocket up his ass and lighting the back end of it. Maybe we can wait until we identify some asteroid on a collision course with Earth and send the Elon rocket up there to smash into it, taking care of two existential threats at the same time.

As to theTreasury Bonds, while not suggesting that we sell them all, or that the other big debt-holders do this in concert with us, it still kind of provides some comfort knowing that, at least in one area of economic importance, we hold better cards than they do.